greenville county property tax estimator

The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. Look Up an Address in Greenville County Today.

Greenville Sc Land For Sale Real Estate Realtor Com

Greensville County has one of the lowest median property tax rates in the country with only two thousand three hundred sixty eight of the 3143 counties.

. Greenwood County Tax Estimator South Carolina SC. Greenville County collects on average 066 of a propertys assessed fair market value as property tax. Request Full and Updated Property Records.

The median property tax on a 14810000 house is 155505 in the United States. Ad Get Reliable Tax Records for Any Greenville County Property. This is a TAX ESTIMATE only.

The reader should not rely on the data provided herein for any reason. School Tax Credit Savings. Tax amount varies by county.

Greensville County collects on average 055 of a propertys assessed fair market value as property tax. Estimated Range of Property Tax Fees. The median property tax on a 14810000 house is 97746 in Greenville County.

For comparison the median home value in South Carolina is 13750000. For comparison the median home value in Laurens County is 8580000. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys.

Often your questions can be answered quickly via email. Ad Just Enter your Zip for Online Property Tax Info Near You. --Select one-- Camper - 1050 Vehicle Business - 1050 Vehicle Individual - 600 Watercraft - 1050.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Greenville County. The median property tax in Greensville County Virginia is 523 per year for a home worth the median value of 94600. The median property tax in Greenville County South Carolina is 971 per year for a home worth the median value of 148100.

Pay by Phone for Property Tax. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a median effective property tax rate of 066 of property value. 866-549-1010 Bureau Code 8488220.

Homestead Less School Operations. There are typically multiple rates in a given area because your state county local schools and emergency responders each receive funding partly through these taxes. For an estimation on county taxes please visit the Greenville county or Laurens county.

Greenville TX 75403. Thank you for your patience while we upgrade our system. Real estate assessments are undertaken by the county.

No title work after 345 pm in the Motor Vehicle Department. Lexington County makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein. South Carolina is ranked 1523rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Laurens County Tax. The county is providing this table of property tax rate information as a service to the residents of the county. Please note that we can only estimate your property tax based on median property taxes in your area.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Personal property returns cannot be filed electronically. Contact your county tax.

Left to the county however are appraising property sending out levies making collections enforcing compliance and addressing disagreements. Expert Results for Free. If your vehicle is improperly qualified or you are uncertain whether your vehicle would be eligible for car tax relief because it is used part of the time for business purposes contact the Greensville County Commissioner of the Revenues Office at 434-348-4227.

The calculator should not be used to determine your actual tax bill. Estimate Your Home values for Free Connect with Top Local Real Estate Agents. Tax rates vary according to the authorities ie school fire sewer that levy tax within individual tax districts of Greenville County.

The median property tax on a 14810000 house is 74050 in South Carolina. Estimate NOT applicable on split ratio properties. This calculator is designed to estimate the county vehicle property tax for your vehicle.

Each individual taxing unit is responsible for calculating the property tax rates listed in this table pertaining to that taxing. Search Any Address 2. Be Your Own Property Detective.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Please enter the following information to view an estimated property tax. Greenville County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by.

See Property Records Tax Titles Owner Info More. This website is a public resource of general information. Search For Title Tax Pre-Foreclosure Info Today.

Begin Estimating Property Taxes. Your county vehicle property tax due may be higher or lower depending on other factors. The median property tax also known as real estate tax in Greenville County is 97100 per year based on a median home value of 14810000 and a.

Greenville establishes tax rates all within South Carolina statutory guidelines.

What Does Annexing Actually Mean For Greenville And You Gvltoday

Property Tax Rates For New London County In 2020 Randall Realtors

Proposed Travis County Property Taxes Listed On Website Kvue Com

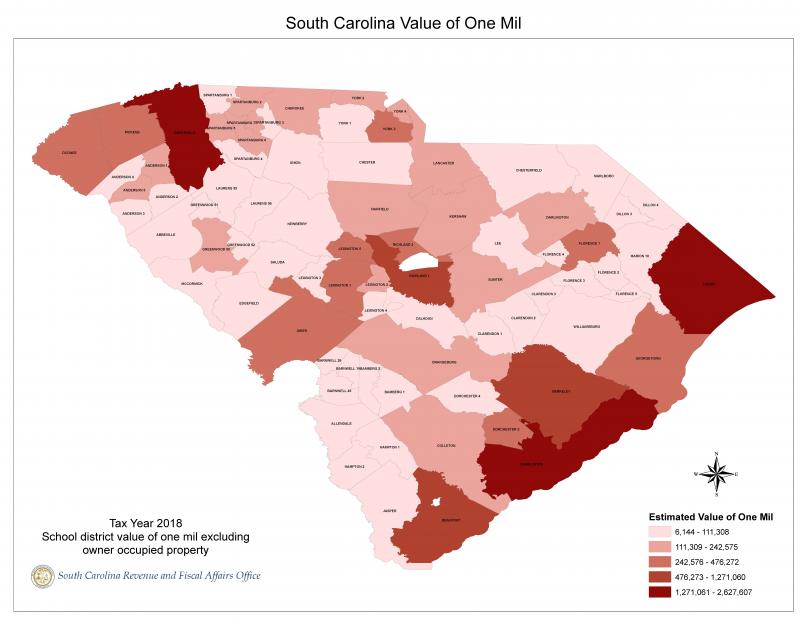

Property Tax Reports South Carolina Revenue And Fiscal Affairs Office

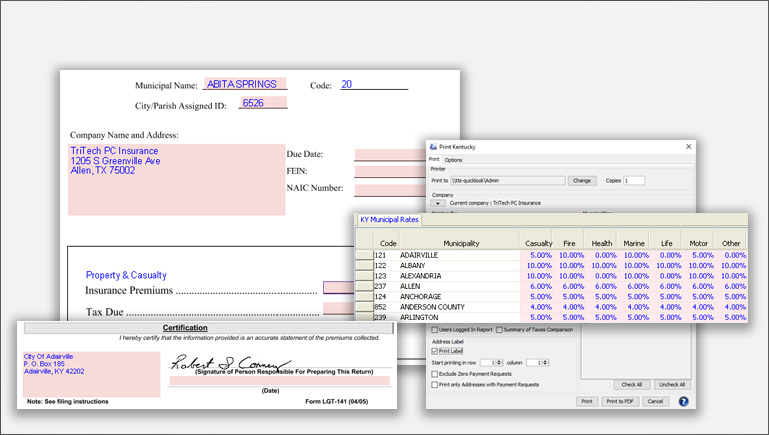

Municipal Tax Tritech Software

What Does Annexing Actually Mean For Greenville And You Gvltoday

Tennessee Property Tax Calculator Smartasset

South Carolina Sales Tax On Cars Everything You Need To Know

Greenville Sc Land For Sale Real Estate Realtor Com

Greenville County School Board Notes District Tries To Stay Ahead Of Growth Greenville Journal